U.S. Federal Reserve banking system to launch FedNow digital payment service that removes financial privacy and lets them surveil your transactions easier

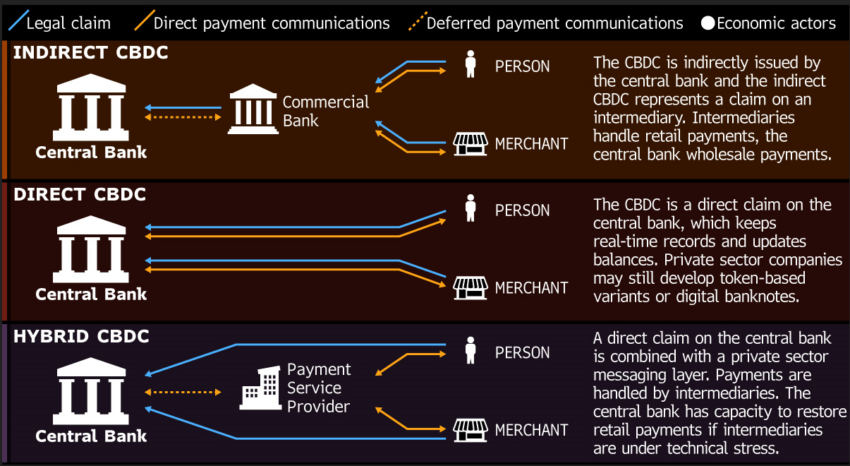

The debut of a CBDC through FedNow could conceivably open doors for amplified government surveillance of private financial matters.

In July, FedNow, the digital payments system of the U.S. Federal Reserve, is scheduled to commence operations. The system, characterized by Richmond Fed President Tom Barkin as "resilient, adaptive, and accessible," intends to expedite lower-cost bill payments, money transfers, and other consumer activities.

Despite the fact that central banks all over the world are pursuing Central Bank Digital Currencies (CBDCs), apprehensions regarding the probable implications for financial liberty and confidentiality have emerged.

The debut of a CBDC through FedNow could conceivably open doors for amplified government surveillance of private financial matters.

Robert Francis Kennedy Jr. suggests that with the disappearance of transactional anonymity, central banks would acquire the authority to enforce dollar thresholds on transactions and constrain the place and timing of expenditures. A CBDC associated with digital identification and social credit scores could potentially pose even greater hazards.

Kennedy argues that such a system could empower governments to freeze assets and limit purchases to authorized merchants for individuals who do not conform to specific mandates, such as vaccination prerequisites.

While initially confined to interbank dealings, the introduction of CBDCs elicits anxieties concerning the likelihood of governments outlawing or confiscating decentralized currencies such as Bitcoin, similar to what happened to gold in 1933.

Governments seem to exploit crises like banking instability, hence their endorsement of CBDCs as secure substitutes to paper currencies and as a safeguard against bank runs.

Thanks for visiting Our Secret House. Create your free account by signing up or log in to continue reading.